Debugging a Strategy¶

Our crossover strategy from before does not seem to work. To improve upon your strategies, it can be helpful to visualize them.

First, we create our builder object again.

[3]:

from simple_back.backtester import BacktesterBuilder

builder = (

BacktesterBuilder()

.name('JNUG 20-Day Crossover')

.balance(10_000)

.calendar('NYSE')

.compare(['JNUG']) # strategies to compare with

.live_progress() # show a progress bar using tqdm

.live_plot(metric='Total Return (%)', min_y=None) # we assume we are running this in a Jupyter Notebook

)

Plotting Additional Metrics¶

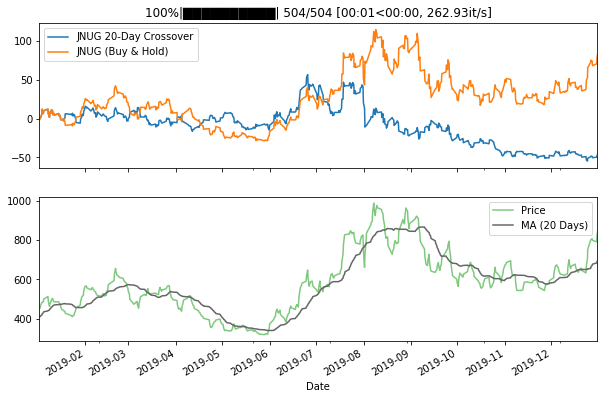

Now, we can start by logging the moving average and price of JNUG with .Backtester.add_metric.

[3]:

bt = builder.build()

for day, event, b in bt['2019-1-1':'2020-1-1']:

if event == 'open':

jnug_ma = b.prices['JNUG',-20:]['close'].mean()

b.add_metric('Price', b.price('JNUG'))

b.add_metric('MA (20 Days)', jnug_ma)

if b.price('JNUG') > jnug_ma:

if not b.portfolio['JNUG'].long: # check if we already are long JNUG

b.portfolio['JNUG'].short.liquidate() # liquidate any/all short JNUG positions

b.long('JNUG', percent=1) # long JNUG

if b.price('JNUG') < jnug_ma:

if not b.portfolio['JNUG'].short: # check if we already are short JNUG

b.portfolio['JNUG'].long.liquidate() # liquidate any/all long JNUG positions

b.short('JNUG', percent=1) # short JNUG

Plotting Lines¶

We can see that the moving average crosses the price many times, causing buy and sell signals just because of noise. We will try to calculate the average of 60 instead of 20 days instead, in the hope of crossover events being fewer and more meaningful. We will also use .Backtester.add_line to draw a green line when we go long and a red line when we short.

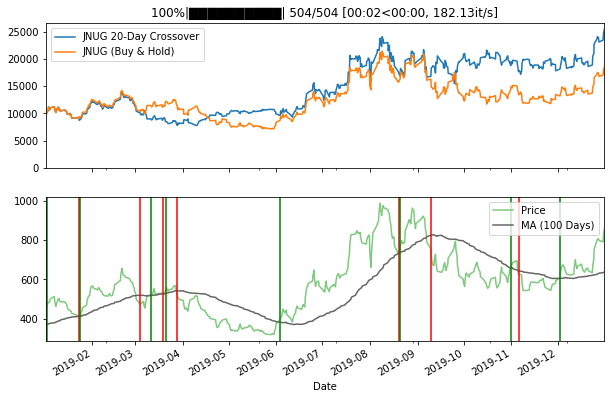

[5]:

bt = builder.build()

for day, event, b in bt['2019-1-1':'2020-1-1']:

if event == 'open':

jnug_ma = b.prices['JNUG',-60:]['close'].mean()

b.add_metric('Price', b.price('JNUG'))

b.add_metric('MA (100 Days)', jnug_ma)

if b.price('JNUG') > jnug_ma:

if not b.portfolio['JNUG'].long: # check if we already are long JNUG

b.add_line(c='green')

b.portfolio['JNUG'].short.liquidate() # liquidate any/all short JNUG positions

b.long('JNUG', percent=1) # long JNUG

if b.price('JNUG') < jnug_ma:

if not b.portfolio['JNUG'].short: # check if we already are short JNUG

b.add_line(c='red')

b.portfolio['JNUG'].long.liquidate() # liquidate any/all long JNUG positions

b.short('JNUG', percent=1) # short JNUG

[6]:

bt.summary

[6]:

| Max Drawdown | Annual Return | Portfolio Value (Last Value) | Total Value (Last Value) | Daily Profit/Loss (Last Value) | |

|---|---|---|---|---|---|

| Backtest | |||||

| JNUG 20-Day Crossover | -3932.812380 | 2.481914 | 24133.862305 | 24680.546328 | -106.979980 |

| JNUG (Buy & Hold) | -3441.210832 | 1.799052 | 17476.245117 | 17925.556025 | -77.468262 |

The strategy does now slightly outperform just buying and holding JNUG. But thanks to add_line, we see that it is very likely for many signals to be triggered in a row. Let’s try to implement a “cooldown” after a signal is triggered. Whenever we long/short due to a signal, we will wait 60 days before considering other signals.

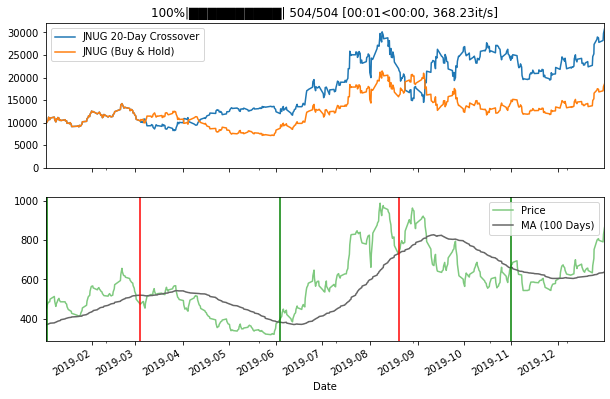

[7]:

bt = builder.build()

for day, event, b in bt['2019-1-1':'2020-1-1']:

if event == 'open':

jnug_ma = b.prices['JNUG',-60:]['close'].mean()

b.add_metric('Price', b.price('JNUG'))

b.add_metric('MA (100 Days)', jnug_ma)

last_pos_date = b.portfolio.attr('date')

if last_pos_date is None:

date_diff = 60

else:

date_diff = (day - last_pos_date).days

if date_diff >= 60:

if b.price('JNUG') > jnug_ma:

if not b.portfolio['JNUG'].long: # check if we already are long JNUG

b.add_line(c='green')

b.portfolio['JNUG'].short.liquidate() # liquidate any/all short JNUG positions

b.long('JNUG', percent=1) # long JNUG

if b.price('JNUG') < jnug_ma:

if not b.portfolio['JNUG'].short: # check if we already are short JNUG

b.add_line(c='red')

b.portfolio['JNUG'].long.liquidate() # liquidate any/all long JNUG positions

b.short('JNUG', percent=1) # short JNUG

[8]:

bt.summary

[8]:

| Max Drawdown | Annual Return | Portfolio Value (Last Value) | Total Value (Last Value) | Daily Profit/Loss (Last Value) | |

|---|---|---|---|---|---|

| Backtest | |||||

| JNUG 20-Day Crossover | -4916.015475 | 2.987039 | 29127.075195 | 29669.710315 | -129.113770 |

| JNUG (Buy & Hold) | -3441.210832 | 1.799052 | 17476.245117 | 17925.556025 | -77.468262 |

Negative Portfolio¶

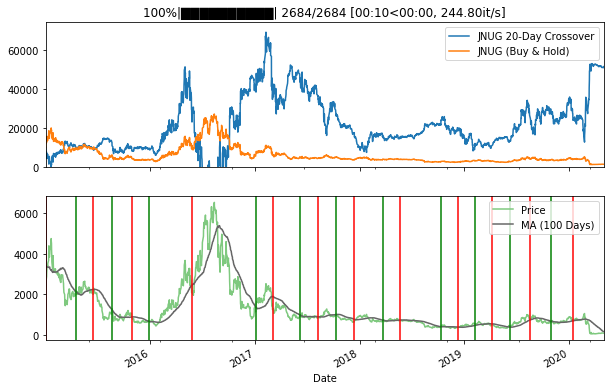

Now the strategy is even more profitable! Of course we are overfitting to our time period here, so let’s backtest all the way back to 2015 and forward to 2020 to include the market crash due to coronavirus.

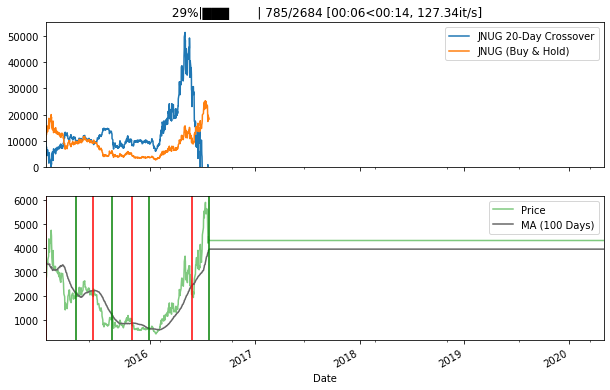

[9]:

bt = builder.build()

for day, event, b in bt['2015-1-1':'2020-5-1']:

if event == 'open':

jnug_ma = b.prices['JNUG',-60:]['close'].mean()

b.add_metric('Price', b.price('JNUG'))

b.add_metric('MA (100 Days)', jnug_ma)

last_pos_date = b.portfolio.attr('date')

if last_pos_date is None:

date_diff = 60

else:

date_diff = (day - last_pos_date).days

if date_diff >= 60:

if b.price('JNUG') > jnug_ma:

if not b.portfolio['JNUG'].long: # check if we already are long JNUG

b.add_line(c='green')

b.portfolio['JNUG'].short.liquidate() # liquidate any/all short JNUG positions

b.long('JNUG', percent=1) # long JNUG

if b.price('JNUG') < jnug_ma:

if not b.portfolio['JNUG'].short: # check if we already are short JNUG

b.add_line(c='red')

b.portfolio['JNUG'].long.liquidate() # liquidate any/all long JNUG positions

b.short('JNUG', percent=1) # short JNUG

NegativeValueError: Tried to liquidate position resulting in negative capital -2483.530529785243.

Seems like our portfolio dips into the negative mid-2016. We can awoid this error by not liquidating when our short position is negative.

[10]:

bt = builder.build()

for day, event, b in bt['2015-1-1':'2020-5-1']:

if event == 'open':

jnug_ma = b.prices['JNUG',-60:]['close'].mean()

b.add_metric('Price', b.price('JNUG'))

b.add_metric('MA (60 Days)', jnug_ma)

last_pos_date = b.portfolio.attr('date')

if last_pos_date is None:

date_diff = 60

else:

date_diff = (day - last_pos_date).days

if date_diff >= 60 and b.portfolio.total_value >= 0:

if b.price('JNUG') > jnug_ma:

if not b.portfolio['JNUG'].long: # check if we already are long JNUG

b.add_line(c='green')

b.portfolio['JNUG'].short.liquidate() # liquidate any/all short JNUG positions

b.long('JNUG', percent=1) # long JNUG

if b.price('JNUG') < jnug_ma:

if not b.portfolio['JNUG'].short: # check if we already are short JNUG

b.add_line(c='red')

b.portfolio['JNUG'].long.liquidate() # liquidate any/all long JNUG positions

b.short('JNUG', percent=1) # short JNUG

Zooming in¶

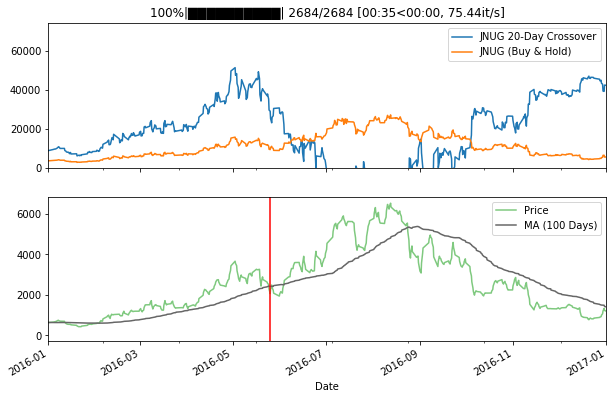

The strategy does not fail anymore, but the drawdown seems significant. We can have a look at the period the plot is negative using .Backtester.show

[11]:

bt.show('2016-1-1','2017-1-1')

Accessing Metrics¶

We can also check the minimum value of the backtest. There are two main ways of accessing an individual Backtests’ metrics, either by using .StrategySequence or by selecting its index in the full .Backtester.metrics dataframe.

[12]:

bt.metrics.loc['JNUG 20-Day Crossover']['Total Value'].min()

[12]:

-33452.41876081888

[13]:

bt.strategies[0].metrics['Total Value'].min()

[13]:

-33452.41876081888

The strategy might seem profitable, but holding a short position with a value so negative would not be possible.